How to put together and read a MIS

Running or working-in a startup comes with its own challenges. Among others, one challenge I often find founders and startup executives struggle with is setting up a MIS. A Management Information System (MIS), is a summary of the performance of the business (startup) over a period of time - say a month, quarter, or a year. MIS can also be called your growth accounting statement. I prefer MIS, short and better! It is also a more popular term.

MIS is used by investors of the company (startup) to understand what happened in the business. It is also used by prospective investors to understand the performance of the business while making an investment decision. Lastly, it (should be) used by founding and management team of the company to take key decisions.

Of the above three, the last one is the most important! Unfortunately, in the valuation chasing world that we live in, MISs are made only for the first two - optics, optics, and more optics. But as I have said before, growth finance including its tools such as MIS is a great way to set up a culture of data driven decision making.

Thus, build your MIS for your internal decision making and tracking. Send what you look at internally to investors. Not the other way around.

You will see how to read MIS in the last section of this post. If you already know how to make an MIS, you can directly go to the last section

Pro tip: Investors look at the quality of your MIS. It tells them how data-driven are you as a company.

Another pro tip: If you take too much time sending MIS or basic data to investors, it is usually understood that you are not on top of your data, and you are only creating data for investors. That is not a good sign.

The components of a MIS

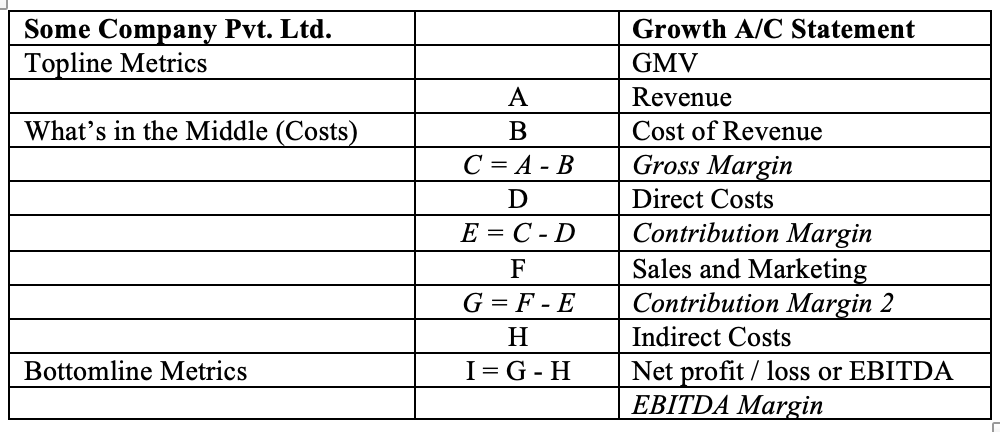

Like a regular accounting statement which has revenue, costs, and profits or loss, MIS also has three basic components - topline (revenue or GMV), costs, bottomline (profit, EBITDA etc.)

Read my previous post on topline - Lets demystify GMV

Costs are very important in the context of startups because startups spend ahead of time for futuristic growth. Thus, It is important to view costs in a strategic order. I like dividing costs in 4 buckets

Cost of revenue: This is the cost of what you sell. For example, if you are a retailer, your cost of revenue is cost of good sold (COGS). If you are a software company, it could also be your cloud hosting charges. Discounts also form cost of revenue.

Direct costs: Costs that are directly proportional to the revenue are clubbed under direct costs. Example, cost of shipping, cost of payment gateway etc.

Sales & marketing costs: All marketing and sales spend goes here including payroll of the these teams. It is important to look at this metric separately because for a new company, sales and marketing is very strategic.

Indirect costs: These are mainly fixed costs, the costs that don`t scale with your revenue (to an extent). Payroll, office rent etc. comes here.

The cost bucketing allows for one to look at key margins which are critical to understanding the cost efficiency, or lack thereof, in a growing business. These margins are defined by Gross Margin, Contribution Margin, Contribution Margin 2, and finally EBITDA or Gross Profit. The basic structure of a fictitious company will look something like in the table below:

Understanding margins

Startups burn money and margins help understand where they are burning money. The reason we break costs the way described in the section above is to see different margins and their interplay. Lets talk about them.

Gross margin (GM): GM helps you understand what is the inherent margin in selling a product or a service. For example, if you buy something for $90, and sell it for $100, you make 10% gross margin ((100-90)/100). Now with this $10, you have to pay for shipping, packing, customer services etc etc. What if this was just 2% or $2 in a $100 product. Would you still want to do this business online, for example? The inherent cost structures would make this a difficult proposition. Discounts also come here. That is why VCs like Software companies, the inherent gross margins in those businesses are usually north of 80%. While there are many companies that are built around low GMs, there is a long term play there on volume and increasing margins etc. (a topic for a different post)

Contribution Margin (CM): Continuing from the above example, from that $10, say you spend $5 on shipping and $1 on packaging, the contribution margin will be $4 or 4% ((10-5-1)/100). Of course, there could be many other direct costs in the business but the principle is to see if taking all those direct costs into account can the business ever make money if it does not already; when direct costs go down as % of revenue with scale? This is one of the biggest questions you should try to answer while picking a sector. Look at all costs that are directly proportional to delivery / fulfilment of your product / service and put them here.

Contribution Margin 2 (CM2): In a rapid-growing business, sales and marketing play a very important role. As I have states before, as a VC-funded startup, one of the objectives is to capture the market faster than competitors. In the process, startups burn a lot of sales and marketing dollars which could skew the current cost structures Thus, we want to carve out a separate margin item to view the effect of S&M expenses on the financial numbers.

A business may have a very high CM but very bad CM2 (even at scale). That means that while this product or service it profitable, it is hard to get users to buy it (today) from the current channel of delivery (online). The startup may have to create this category by incentivising users; remember those early days of crazy eCommerce discounts? The belief here is that with scale, marketing should go down as percentage of revenue. We are going to talk about this in a lot more detail in future posts. This is the most interesting pa

EBITDA Margin: Finally EBITDA margin is what money you make after subtracting your indirect costs. It is important to track this metric because indirect costs don`t grow proportionately with revenue and with scale EBITDA margin begins to unlock.

The next section will help you understand how all this comes together

Interplay between GM, CM, CM2, and EBITDA

I will use this section to help you understand what it means to have these margins negative or positive and how read them together. To do this, let’s bring back Some Company Pvt. Ltd. (SCPL) that I introduced in the beginning of this chapter and let us give it some more soul. That is, SCPL is an internet-first brand of fast-fashion clothing line for women, like a Zara equivalent but only online. Below is a SCPL MIS that takes the journey of the company to Year 1 of its founding to Year 5.

Year 1: Startup is GM negative. The Startup has just raised a $5M series A and launched the website. It is spending money on advertising campaigns on Instagram, Facebook, and Google to attract new customers. Further, they are giving promotional discount offer of 40% throughout the year. The founders just want customers to try out the products in this phase of growth.

Year 2: Startup turns GM positive. Customers love the products and come back for repeat orders. Consequently, the share of repeat orders has grown, and discounts only run every alternate month. Instagram followers, Facebook engagement, Google reviews are growing in a healthy manner. The startup raises $20M in Series B. The board and the founders decide to ramp up the tech and product team and make key hires this year: Head of Customer Experience, Head of Product and COO who is going to look at direct costs (delivery, packaging etc.) deeply. Indirect cost goes up by 300%.

Year 3: Startup turns CM neutral. The added scale of operations and the acumen of the new COO worked wonders. The Head of Customer Experience also made the call-centres efficient through technology and process innovations. With marginal increase in the direct cost capacity, the startup was able to handle 5x increase in business. The startup breaks-even on operations. Share of repeat customers continues to go up. The startup commands respect among the shoppers for its product and get customers organically (without spending any marketing dollars). Thus, marketing spend is marginally increased. The board and founders continue to beef up technology and product teams to further the tech advantage against the competitors.

Year 4: Startup turns CM2 positive. 2.5x growth in business brings more efficiencies in operations; CM grows to healthy 11%. Share of repeat customers is 80% (one of the best in the industry) and hence marketing spends are more around brand-building and retention and are marginally more than last year. This year, the indirect costs only grow by 10% (hikes) and have become more business as usual.

Year 5: Startup turns EBITDA positive. Business grows 2x bringing efficiencies across GM and CM due to scale. Both marketing costs and indirect costs increase marginally, throwing for the first-time profits (before taxes, assuming there is no significant interest and depreciation expense). Everyone is happy now. Let`s IPO!

We VCs want to see such MISs in our portfolio companies. It would be ideal, but it rarely happens. Some take 2 years to become CM positive, and some even take 5. Some never turn EBITDA positive, and continue to chase growth through large capital infusions; the market is big and there is competition to win it.

I have never seen an MIS like that in a consumer company to this day. The market realities are far too different. But I hope this example gave you a gist of the interplay between the margin and of the meaning when they are positive or negative.

Segregating the regular P&L statement in a growth accounting statement like this one helps you focus on the right things vis-à-vis the stage of the company. For example, in early years the focus should be on getting the GM and CM right. In a growing company, VCs want founders to spend money on marketing and are okay with CM2 being negative, as long as it is on an upward trajectory.

In subsequent posts, I will discuss some of these concepts in much more depth. Maybe I will even do more sample MISs. You can comment if you want me to talk about something specific -maybe your company`s MIS. You can also join our community on Qoohoo clicking the button below. Note: open in mobile phone (we are in Beta, sorry for inconvenience)

IRL quite a lot companies especially outside the US will have multi-market, multi-product, even multi-ICP strategy once they are at growth stage, which will complicate the MIS. If not broken down, readers of MIS will lose a lot of insights.